Due to the fact that two-wheeler insurance is required and offers financial security, people purchase it. Nobody wants to find themselves in a situation where they have to file a claim because of an unfortunate event.

Under a comprehensive bike insurance policy, a claim typically arises under the following circumstances:

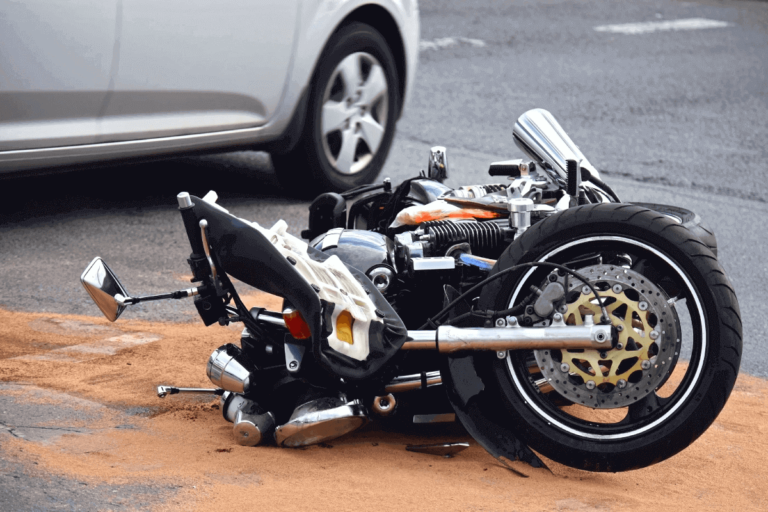

- When your bike is damaged in an accident

- When you’re injured

- When you cause harm to another person or their property

- If the bike is stolen

For a quick and smooth bike insurance claim settlement, follow the specific procedure. Any deviation or error might complicate the process and affect the settlement.

Do’s And Don’ts When Submitting A Two-Wheeler Insurance Claim:

- Notify The Insurance Provider Right Away

Immediately notify your insurance company after a bike insurance claim. This initiates the registration process, and you can follow up for a speedy settlement. For cashless claims, the company can help you find the nearest network garage.

- Take The Bike To A Recommended Network Workshop

The insurer’s recommended network garage should be used to repair the bike if you want a cashless claim settlement. The network garage accepts cashless repairs and has a relationship with the insurance provider.

- Fill In The Policy’s Correct Details

You must enter your bike insurance policy details when submitting an online claim. Take care when entering the information. The claim would be delayed if the details were incorrect.

- Report The Type Of Claim

There are two kinds of two-wheeler claims: third-party and comprehensive. It would be a third-party claim if you injured someone else or damaged their property. However, there would be a comprehensive claim if your own bike was damaged. Recognise the types of claims covered by your online two-wheeler insurance policy and file the appropriate reports. All aspects of insurance can be managed using a vehicle insurance app. Claims are subject to terms and conditions set forth under the motor insurance policy.

- Avoid Making A Claim For An Exclusion

The policy contains a few exclusions. Exclusion claims are denied by the insurance provider. Therefore, if a claim is made in the policy for an instance that is excluded, do not make it.

- If Necessary, File A Police FIR

It is necessary to file a First Information Report (FIR) in the event of third-party claims. Prepare a copy of the FIR and file it along with your claim. When filing a claim for a third party, the insurance company will request a copy of the FIR.

- Keep The Documents Handy

In addition to notifying the insurance company and submitting the claim form, there are other paperwork that needs to be completed when you file a claim. In order to expedite the claim procedure, you can also upload the documents online. You need the following documents: insurance policy document, RC Book, driver’s license , etc. Have these materials close at hand when submitting the Bajaj Allianz bike insurance claim. Each insurance company has a different procedure for this.

These filing tips will make it simple and quick for you to file and settle your claims. Thus, exercise caution both when purchasing insurance for the scooty and when filing a claim. Don’t forget to renew your motorcycle insurance on time.

Get insured anytime, anywhere! Check out Bajaj Allianz General Insurance website to learn more and download the app now.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.